Diesel prices are high — here’s what’s going on

We’ve all been hearing a lot about refinery margins and the price of refined products — especially diesel. We’ve also been hearing a lot of inaccurate or partially-accurate information. Here’s what’s really going on.

TLDR; the current high diesel prices are fundamentally the result of demand outpacing supply. There are four primary drivers of this imbalance:

1. The cost of crude oil

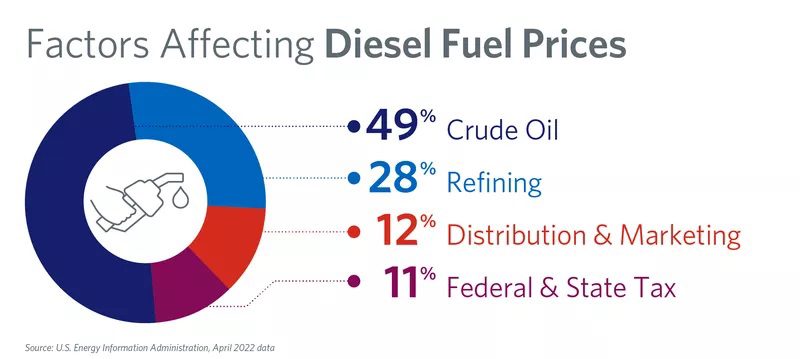

Coming out of the pandemic, global demand for fuel has recovered at a much faster pace than global crude oil production, the primary feedstock for both gasoline and diesel fuel. That imbalance was one of the first triggers of our current fuel price challenges and is still the major factor. The cost of crude oil accounts for nearly 50% of the cost of diesel according to April 2022 data from the U.S. Energy Information Agency.

2. Global refining capacity losses

Refining capacity losses — essentially the volume of crude oil refiners can process daily — have also created a bottleneck. Since 2020, the world has lost about 3.2 million barrels a day of capacity with roughly one-third of the losses occurring in the United States. Europe also shuttered or transitioned some facilities away from petroleum refining. European refiners predominantly produce diesel, and reduced refining capacity left Europe more heavily dependent on imports, specifically imports from Russia.

3. The geopolitical factor

Speaking of Russia, its war on Ukraine has had a significant impact on energy markets. Many countries are shunning Russian crude and refined product leading to reduced utilization of Russian refineries, with the IEA estimating that Russian refinery throughput would fall 1.1 million bpd in 2022.

These reductions are being felt acutely in Europe as diesel from Russia makes up between 40% to 50% of its diesel imports. Replacing that volume in a tight global market is quite a challenge and represents a sudden and dramatic shift in global trade flows that has been extremely disruptive to the global economy. The diesel shortfall in Europe is driving up prices there and because the diesel market is global, the higher prices in Europe are causing diesel to be rerouted there from markets around the world and driving up prices around the world as well.

4. Inflation

Fuel manufacturing is not immune to inflation. The refining sector is facing the same supply chain shortages, higher feedstock prices, increased labor costs and higher “costs of everything” that are plaguing the wider economy — all of which add to the final price of diesel. Notably, prices for natural gas — an energy source powering many refineries — have surged in the past year and especially in the wake of Russia’s war.

These factors have contributed to a tight global diesel market. We are, however, starting to see signs that the market is beginning to work it out as diesel inventories are increasing in the United States and prices in Europe are starting to moderate.

Stand With Us

Join our community of employee advocates. Sign up for new content delivered straight to your inbox.